Current risks to US Economy

Published:

Current risks to US Economy

As of date - 20th March-2022, there are multiple risks associated to US economy. Inflation, Covid-19 and Country War.

How stimulus bet turned out

Inflation has increased 40 year high with 7.5% but supply chain disruption could be reason also.

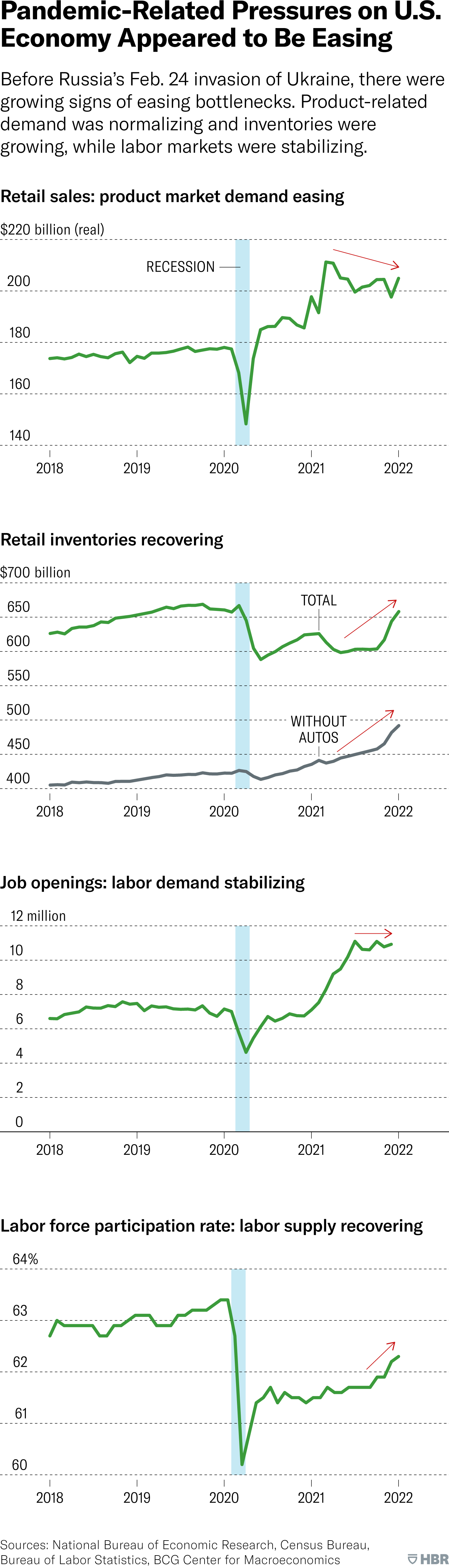

Pressure appeared to have peaked

Retail sales, retail inventories and labor participation looks good.

How the War Drives Up Recession Risk

Impact could be through three transmission channels.

- Financial Recession - Liquidity or capital problems.

- Real Economy Recession - Drive demand or supply shocks.

- Energy Prices(direct effects) - Oil going up.

- Energy Prices(confidence impact) - Consumer confidence going down.

- Wealth Effects - Inflation make people feel less wealthy.

- Supply-Chain Disruptions - Supply Chain being broken.

Despite the headwinds of War Crisis, its not clear that it outweighs the tailwinds of the US Economy positives.

- Growth is decelerating but seems stable.

- Household looks healthy.

- US and Russia linkage is less.

- Labor market remain tight.

- Firms remain profitable.

A policy Error Remains the Central Recession Threat

- Wrong tighting of interest rate can lead to recession.

- Less tighting of interest rate can lead to further inflation.

What Executives can do

- Dont rely on the forecasts.

- Do build the capabilities to analyze and model the transmissions of shocks and stress test using planning

- Dont assume shocks drive structural changes.

- Dont assume that pricing power persists.

- Do think of productivity growth as competitive advantage.